I’m sharing my Chime Review and why I needed a Chime account. Read about the pros and cons of using Chime, an online banking service. This post is sponsored by Chime, but the content and opinions expressed here are my own.

Chime Review | Why I Needed A Chime Account

Over the last month, I’ve shared my journey with Chime on our Instagram channel. My curiosity to check out this banking service with an award-winning mobile app started with seeing their advertisements. Hearing terms such as “getting paid early” and “banking made easy” was enough for me to sign up for an account. Being able to partner with Chime to share my experience with using their mobile app was another perk. However, I’m sharing both pros and cons of using Chime.

With my busy lifestyle, along with the status quo of our country, having the option to bank right from my phone is a huge plus. Gone are the days of going into the bank to take out money, deposit checks, or make transfers. With Chime, you can do that right on their mobile app. Yes, you can also do this with many other banks and credit unions.

Here’s how Chime stands apart from the pack- My Chime Review

Do you like to get paid on time? What about getting paid early? I’m sure the answer to both of these questions is a firm YES! Wouldn’t it be kinda cool to get paid before your co-workers? Talk about bragging rights! Okay, maybe you won’t gloat, but getting paid on time and early is a win-win!

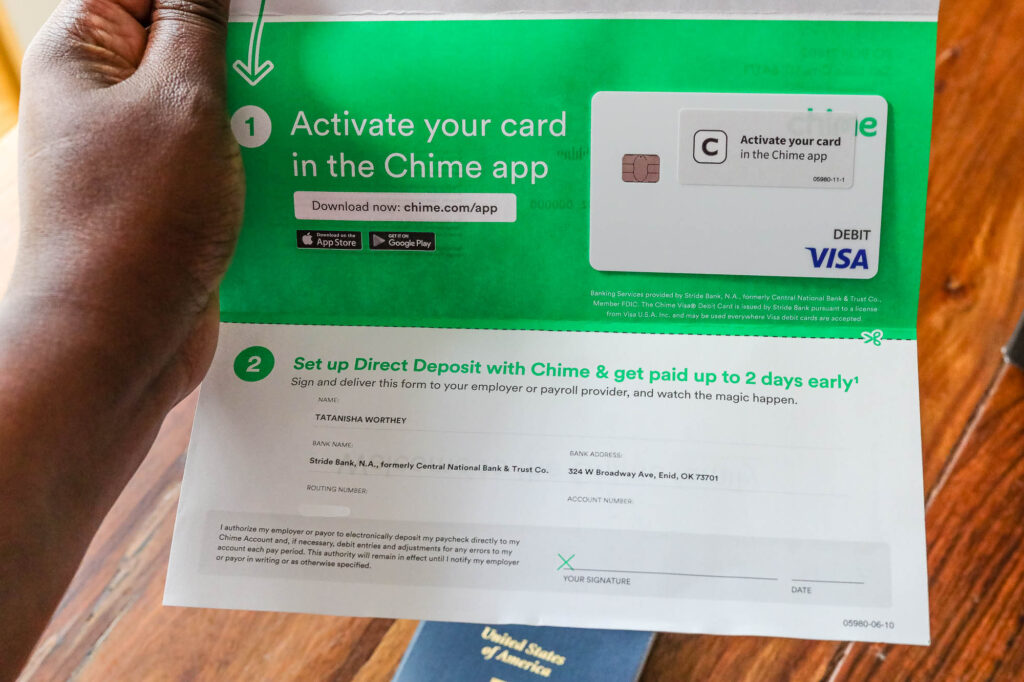

They also sent along the paperwork to set up Direct Deposit.

When you set up for direct deposit, you can get paid up to two days in advance, making it even easier to access your funds and take care of business. This benefit alone is a huge reason why you should have a Chime account.

Are you tired of overdraft fees? Hey, SpotMe! Another benefit of having and using your Chime account is the fee-free overdraft option. Did you know that Americans lose $62,500 in overdraft fees every minute? And the average cost Americans lose at a traditional bank per year is $250! WOW. All those overdraft fees could have gone into your savings account or vacation fund. But no worries, when you use your Chime account, eligible members can overdraft up to $100 without being charged a fee. However, you must have a direct deposit (with a minimum qualifying direct deposit) set up to use the SpotMe option. I don’t recommend using this option, but it is there if you find yourself in a jam.

Chime is all about banking made easy! They also offer:

- Bill Pay services

- Mobile Payments (Apple Pay, Samsung Pay, etc.)

- Options to send money to friends + family

- 100% Transparency on what they do, including any applicable network cash withdrawal fees

- ATM Map provided to help you find a fee-free ATM Machine

- When you sign up and send your referral link to your friends, you will get $50 when they enroll and set-up a qualifying direct deposit of $200 or more within 45 days of enrolling. They will also get $50, so you both win!

Savings account with automatic roundup!

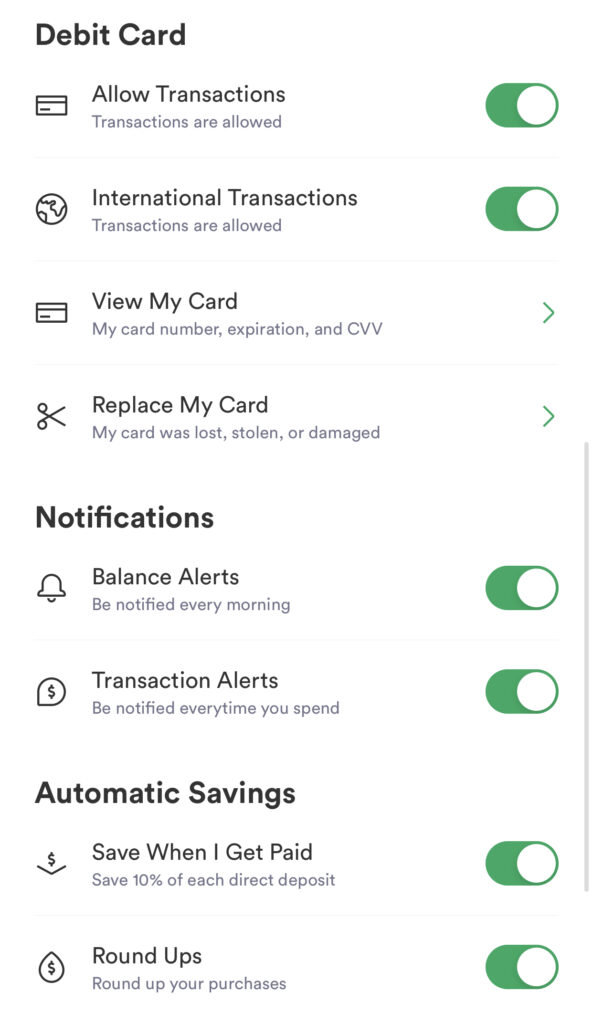

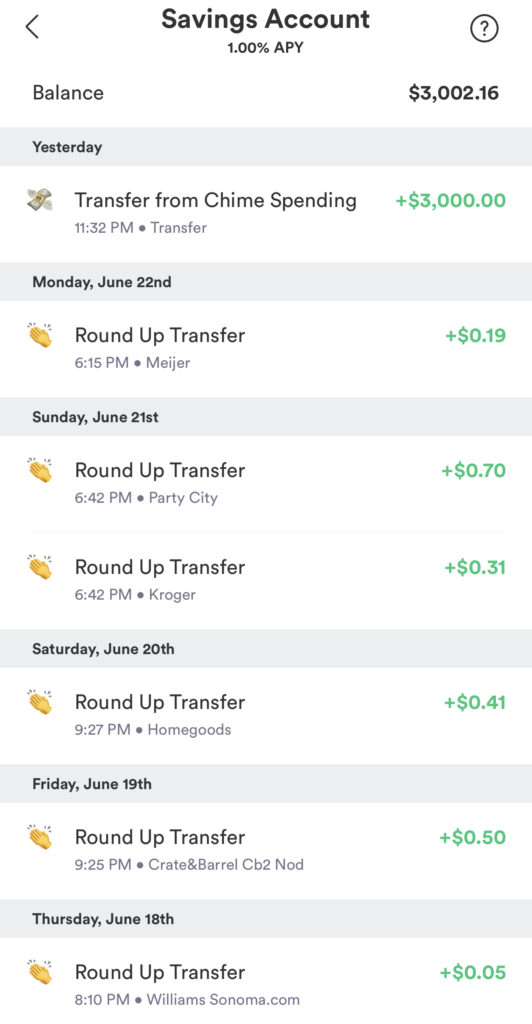

Another benefit I’m loving about using my Chime account is the option to set up a savings account.

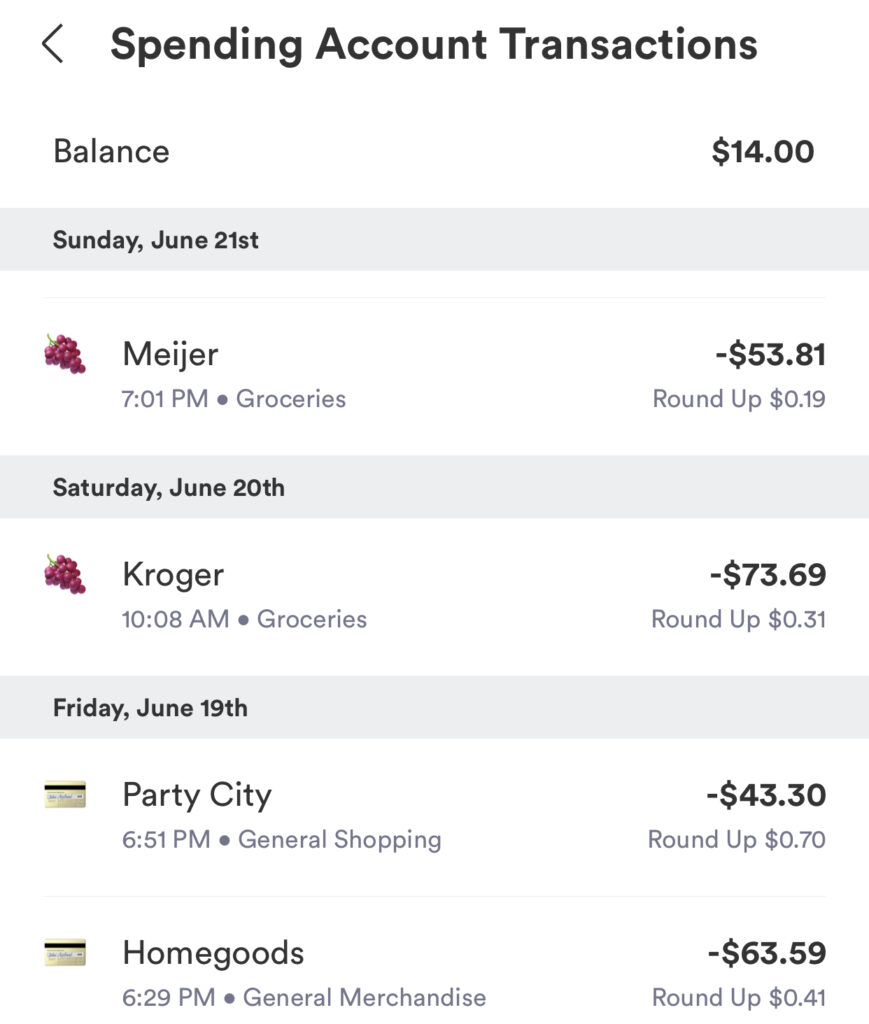

I also activated the roundup feature on my account for additional savings. The roundup option allows you up to round up to the dollar. For example, one purchase totaled $53.81. Chime rounded it up and took the $0.19 and put it in my savings account. Those coins will add up! (see above)

What I don’t like about Chime (but it’s also a perk)

There was one drawback from banking with Chime. However, it’s also a plus. When you set up a transfer to/from your Chime account to an outside bank account, it takes a few days. I initiated a transfer on 6/24. They took it out of my other bank account on 6/25. And it was deposited and available for use in my Chime account on 6/29.

This could be a con for some that need to have their funds right away. You can use the Chime Visa® Debit Card to withdraw funds from the ATM, but there is a daily limit. If you’re paying for emergency services, you can also use your Chime card to pay.

While this may be a con, it’s also a plus. Not being able to access your cash right away will help you rethink that purchase or the need for the money. This is a benefit if you’re looking for ways to save money in an account you can’t easily access (going into the bank to withdraw money).

Why you need another banking service

Did you know the recommendation by many financial gurus is to have at least seven bank accounts? I recently watched a video where a savvy expert shared her system and how she uses each account. There is a method to this madness, and that is one of the main reasons I signed up for a Chime account. I have specific goals and methods on how I plan to use this account, and the benefits Chime offers is just what I need.

And that’s another pro! It was SUPER easy to open up an account. I was able to open my Chime account within 2-3 minutes. The Chime app was user-friendly, and also includes a section where you can chat with customer service. My debit card arrived within ten business days.

Why I Needed A Chime Account – My Chime Review

As a busy mom of three, running multiple websites, and a household, I needed a Chime account. Chime allows me to bank on the go. They even have no foreign transaction fees, so I can travel internationally and still use my Chime card for free.

Now it’s your turn! Sign up for Chime. It’s free to apply for an account, and it won’t affect your credit score. When you sign up for a Chime account, you will get a Chime Visa® debit card, a Spending Account, an optional Savings Account, and the ability to use the user-friendly award-winning mobile banking app!

With so many great features and benefits, having a Chime bank account and access to use the mobile app fits perfectly into my busy lifestyle.

Antoinette says

I have been reading up on Chime and I am glad you shared the pros and the cons. I am still in my research phase, but will definitely come back to this post if I sign up.

T Worthey says

Hey Antoinette, You’re welcome! Let me know if you have any questions. I’ve been using Chime for a few months now and I love the benefits!

MJ says

A chime account is just what I need for my garden projects. With some big projects on the horizon, it will be great to have the money for them in one account. Definitely a great way to stick to the budget. Thanks for sharing your pros and cons.